- Article

Building a Life Table for Lebanon: Towards a Deeper Understanding of Our Future

- Natalia Bou Sakr,

- Stéphane Loisel and

- Yahia Salhi

- + 1 author

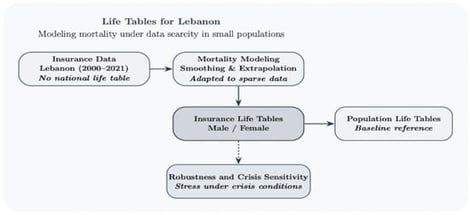

Lebanon does not have a national mortality table that reflects its demographic and health conditions. Despite ongoing changes in mortality patterns driven by economic crises, political instability, and social changes, outdated foreign tables such as AM80 remain in use in the insurance and public sectors. This dependency introduces significant risks in actuarial calculations, policy design, and long-term planning. This study addresses this gap by building a mortality table specifically adapted to the Lebanese insurance context, together with a first estimation of population-level mortality. In the absence of any official mortality database, we collaborated directly with local insurance companies to access and organize internal records of insured lives. These data, which represent one of the few available structured sources of mortality information in the country, form the core of our analysis. We apply actuarial methods to estimate age-specific death rates and life expectancy and benchmark the results against national and international references to assess consistency and range. By offering a locally grounded, data-driven alternative to imported mortality assumptions, this work fills a critical statistical need. The resulting table supports more accurate forecasting, pricing, and demographic modeling, with applications across insurance, pensions, and public health planning in Lebanon.

5 February 2026